On this post I want to share with you how a plane ticket for 2 people can be covered all for less than $45. You are probably wondering what is the catch, how is it possible that many people pay regular price and not know about this.. Well, I used to feel the same way before I started couponing, (I was skeptical, I wonder does it really work) and many years later I am prove couponing does work and there was no catch to it, all it took was a little hard work.

That being said planning a trip to Hawaii is almost the same (at least in my eyes jejeje) it takes time to plan, collect the points, and once all of that is accumulated then is time to book the flight. It could take about 4 months for u to receive the points needed to book a flight for 2 once you been approved with this specific credit card. Remember these steps are all for booking a flight for 2 people.

The other part you have to be a little more flexible as to the days provided by the Korean Air. We wanted to book our trip near our anniversary and the days available for the round trip was given to us as we booked our trip with Korean Air. Since we booked our trip a few months earlier we did have only a few good options and luckily it worked in our favor. But remember when it comes to points, those award travels are limited and if you plan way ahead of time you might get the exact days you are looking for.

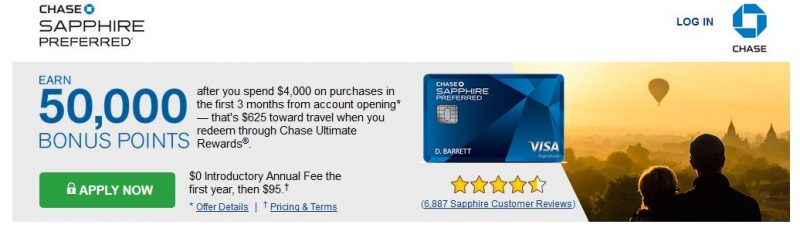

Step 1 – Apply for the Chase Sapphire credit card (but you must use the link provided) Why? because most Credit Cards offer points for travel and one of the top credit card that I enjoy is Chase Sapphire (they offer 50k points but in order to reach those points you must charge around $4000 in a period of 3 months using the credit card)

(Not Approved)

Step 1 – (Let say I applied but didn’t get approved, then don’t feel bad now you know is time to work on your credit, I have helped many people work on there credit that didn’t get approved and after some changes they were able to get approved and started collecting points for travel)

Most common areas I see that needs improvement on there credit is the following:

- Open accounts with no activities – credits cards that are open (and has no balance) but not being used at all, this affect your score, if you are not using it and don’t plan to then close that account (call the company and close that/those credit cards)

- Not aware of there credit score – is a must to know and work on your credit score, you can install the app credit karma or sign up to Credit Karma on your computer check your score and see what else is bringing down the score. You cant fix what you don’t know, is best to look at it at least twice a month

- Paying the minimum – you cant help bring your score up if you continue to make charges and just pay the minimum, in order to improve your score don’t charge anything to your credit card if you can only afford to pay just the minimum.

- What I do and seen how my credit score and credit limit has gone up is pay all of my bills and charges on my credit card (only the necessary monthly charges) and before the month end (or the ending cycle) I make my payments so by the time I receive my statement the new balance is $0

- Collection Debt – an invoice that was sent to collections but you weren’t aware of this charge or the charge was paid and it was still sent to a collection agency, this affect your score and you must tackle this situation, if it was paid call the company that billed you or the collection agency to make sure this is removed and clear in your account. If there is a charge you wasn’t aware about call that company and find out why that is shown on your credit report.

- Not enough credit history – this is a sad and hard issue since you don’t have credit history not many companies are willing to accept and honor you a credit card on this case what I do is add them to one of our credit cards as an authorized user, they use the credit card and pay for the items purchased and since we have good credit score quickly we see there credit score going up. After a few months they apply for there own credit card and they are approved.

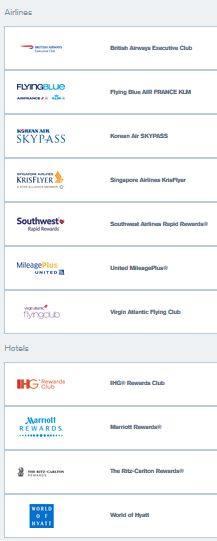

Why Chase Sapphire is a great card? simply because those points you earned can be transfer to a numerous airlines and hotels, you are not stuck to one company and if you decide to use one airline today, you can book another trip with another airline or hotel.

Airlines

- British Airways

- Flying Blue

- Korean Air

- Singapore KrisFlyer

- Southwest

- United Airlines

- Virgin Atlantic

Hotels

- IHG Hotels

- Marriott

- Ritz Carlton

- World of Hyatt

Summary on how to earn travel points

- Apply for the Chase Sapphire (if approved)

- Complete the terms required to earned the points (once you complete the terms)

- You will see points earned in account online & on credit card statement

Total Points you might earned once approved and terms are reached

- 50,000 points (Bonus for signing up)

- 4000 points (charges made)

- 54,000 points so far you can spend for travel

This is part 1 (step 1) on how you can get started to plan a trip to Hawaii with not much out of pocket. As you can see the total I spent on a flight to Hawaii for 2 was less than $45 and for the first year we had this credit card which the annual fee was waived, but if you keep the card for the following year the annual fee is $95. (which is pretty much worth it compare to the amount I saved on 2 plane tickets)

I will share a following post, part 2 (step 2) to making this a lot more affordable. If you have any questions or comments please feel free to share down below..