How to start Bonus Credit Cards but What if I don’t get Approved? is a question I hear most of the times, it can get scary if you are ready to start this journey but then you receive the message that you werent approved.. That thought wont let you get started, so here is how it can help you start your travel journey..

Before we started with miles and points (Bonus Credit Cards) we were paying all cash, since we were following some of Dave Ramsey pay off debt method. This meant we werent using any credit cards at all for a few years, so changing our ways from cash to credit card was a big decision.

We knew if we wanted to travel for free or travel cheap we needed to make some changes to make that happen. Being in debt and not using any credit cards did affected our credit score, which made it a bit low. That didnt stop us from applying to 2 credit cards the first time.

Before starting, dont get discourage

Before following these steps, I ask that you dont get discourage if at first you dont get approved.. First read what my tips are and after you apply if for some reason you are not approved ask what were the reasons, this will help you work on the area that needs it the most.

Now lets get started with some high hopes

Here is the exciting part, How could I get started, which credit card to choose, how does it work and what if I dont get approved? Even starting with high hopes we still ask since this is all new to us..

Here is what I suggest, There are 1 credit card I would like to share with you that can help you get started that offers a great deal of incentives and points you can use for travel.

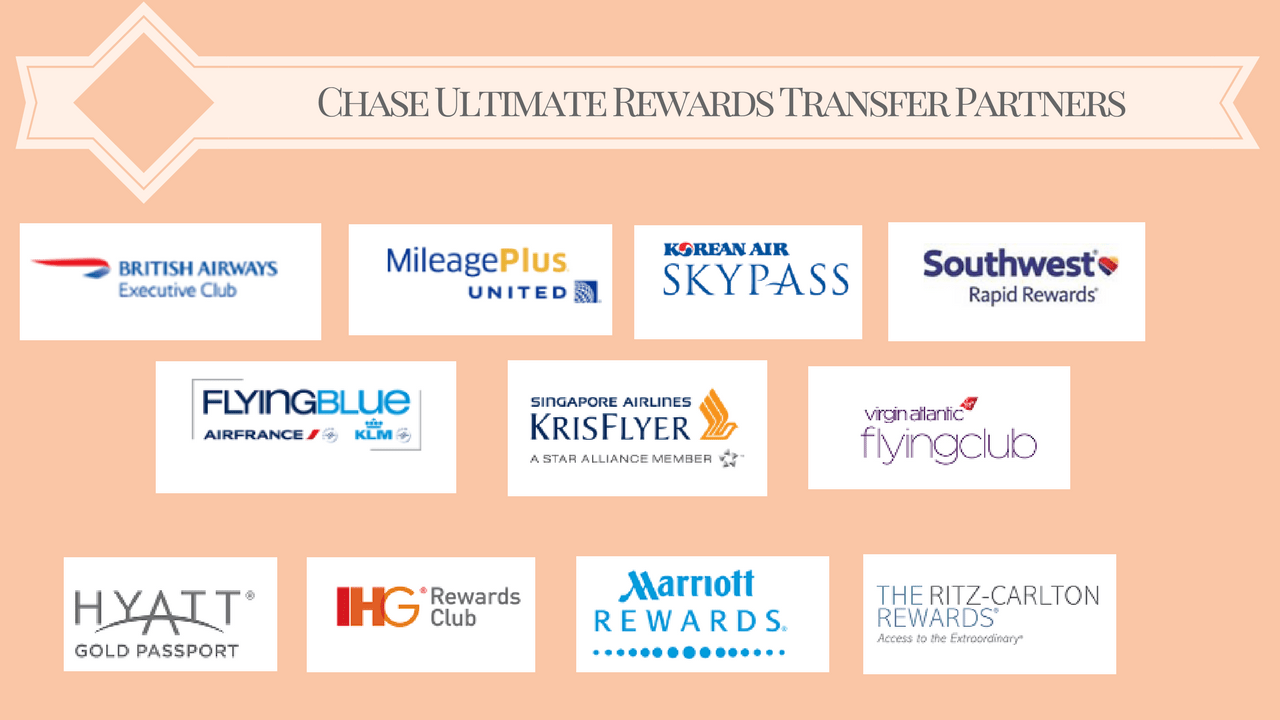

The Best First Bonus Card is Chase Sapphire, this card is very flexible on how far the points go. Some cards are limited on where the points can be used but this card you can use it on there Chase Sapphire Ultimate Rewards portal as well as transferring the points to selected Hotels and Airlines. Before we get ahead of ourselves, these are the benefits of this card.

- Earn 50,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

- Extra 5,000 bonus points after you add the first authorized user and make your first purchase in the first 3 months from account opening.

- Double points (2x) on travel and dining

- Earn 1 point per dollar spent on all other purchases.

This is one of the top credit card that I enjoy Chase Sapphire (they offer 50k points but in order to reach those points you must charge around $4000 in a period of 3 months using the credit card) If you need some suggestions on how to reach $4000 to earn the bonus points, I will be sharing my tips soon as well..

This card is a win-win, you will earn bonus points for adding an authorized user, you earn 2x the points for dining and travel purchases and 1x the points on all other purchases.

Chase Card Benefits

There are many benefits of getting the credit card, you can transfer your points to a list of Airlines and Hotels through the Chase portal. you can also book your flight, hotel or other travel options right on there portal.

Have another credit card as a back up, if my first option was denied. Since my credit score/points doesn’t change on that same day, I then apply to my backup card.

(Bonus Credit Card Not Approved)

If you are considering to start traveling for free using points and miles but know that your score is really low or if you applied and was denied, you can follow these steps to help you improve your credit score

Step 1 – (Let say I applied for a bonus credit card but I didn’t get approved, then don’t feel bad now you know is time to work on your credit, I have helped many people work on there credit that didn’t get approved and after some changes they were able to get approved and started collecting points for travel)

Most common areas I see that needs improvement on there credit is the following:

- Open accounts with no activities – credits cards that are open but not being used, will affect your score. If not being used you can close that account (call the company and close that/those credit cards)

- Not aware of there credit score – is a must to know and work on your credit score, you can install the app credit karma or sign up to Credit Karma on your computer check your score and see what else is bringing down the score. You cant fix what you don’t know, is best to look at it at least twice a month

- Paying the minimum – you cant help bring your score up if you continue to make charges and just pay the minimum, in order to improve your score don’t charge anything to your credit card if you can only afford to pay just the minimum.

- What I do and seen how my credit score and credit limit has gone up is pay all of my expenses/purchases on my credit card (only the necessary monthly charges) and before the month end (or the ending cycle) I make my payments so by the time I receive my statement the new balance is $0

- Collection Debt – an invoice that was sent to collections but you weren’t aware of this charge or the charge was paid and it was still sent to a collection agency, this affect your score and you must tackle this situation, if it was paid call the company that billed you or the collection agency to make sure this is removed and clear from your account. If there is a charge you wasn’t aware about call that company and find out why that is shown on your credit report.

- Not enough credit history – this is a sad and hard issue to deal with since you don’t have credit history not many companies are willing to accept and honor you a credit card with this status. For this type of cases what I do is add them to one of our credit cards as an authorized user, they use the credit card and pay for the items purchased and since we have good credit score quickly we see there credit score going up. After a few months they apply for there own credit card and they are approved. But I only add this authorized user if there social security number is requested since it will show on there credit report.

- There are a few credit cards you can apply that will help you gain some credit history, such as retail stores, one I seen it works pretty good is Victoria Secret.. just a tip ejjeje..

- Apply for a credit builder loan, they are available online and in local credit union. This option might be a little more challenging to do but it could be a great offer if is available and the requirements are doable.

Step 2 – once approved, reach the required limit in the amount given (for example a credit card might suggest in order to receive the bonus points of 50,000 you must spend $4000 in a period of 3 months) so we pay our expenses using that card and pay it off before the statement is sent.

Step 3 – Now that you received your first Bonus from a credit card continue charging purchases to gain more points. Now you are ready to apply for another credit card based on the travel destination you are planning to visit. Remember not all cards will work best depending on the area you are planning to travel to.

Step 4 – once you reach your points needed you are ready to book your trip using the Chase Ultimate Rewards portal and any Hotel credit card you applied for.. If you need help how to book your trip using the Chase Ultimate Rewards you can do so with these easy 7 steps.